Recommended Voluntary Forest Management Practices for New Hampshire

1.4 ESTATE PLANNING AND LAND PROTECTION

BACKGROUND

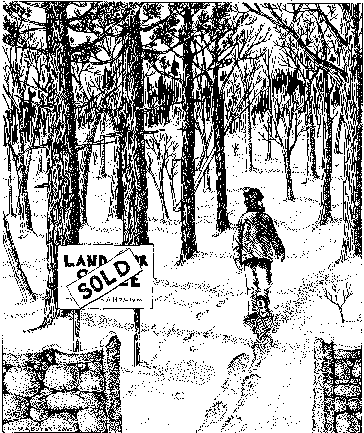

Putting a priority on estate planning and permanent land protection will help ensure future generations will have working forests to manage.

Good forestry requires planning and long-term commitment. The need for estate planning and land protection has never been greater than it is now because of three pressing issues: (1) population growth, (2) land-use change and development, and (3) aging landowners. New Hampshire has been the fastest growing state in the northeast for more than four decades. Population growth and development are exacerbated by an aging landowner population. The average age of private landowners is increasing. Without careful estate planning and more emphasis on land protection, New Hampshire will experience an increasingly fragmented forest landscape with permanent loss of forest.

OBJECTIVE

Use estate planning and land protection as an important part of good forest stewardship.

CONSIDERATIONS

- This chapter discusses issues that have legal implications; don't construe the information here as legal advice. Landowners interested in estate planning and land protection should contact legal advisers and conservation professionals.

- Family Dynamics—Deciding who to involve and how decisions will be made about the family estate is an important first step. It's difficult enough for individuals or couples to make these decisions. Considering the typical situation—aging owners with children, grandchildren and extended family members, all with feelings of entitlement and fairness—it's not surprising decisions are put off. Keeping to a minimum the number of individuals involved isn’t always possible and may not yield the best decisions. Outside help is available through trained facilitators and lawyers with expertise in estate planning.

- Wills—Wills are often the least expensive and most easily completed part of estate planning. Basic wills are essential to just about everyone but critical for individuals and families who own valuable assets such as land. Without wills, forest landowners may commit their heirs to a lengthy estate-settlement process. More highly valued estates, estates with significant landholdings, and estates whose owners have complex family structures often require more detailed wills and refined estate planning. Periodic reviews and updates to wills may be needed to reflect changes in land ownership or family structure.

- Equal Division of Property—Most people have an overriding desire to do the fair thing, sharing estates equally among heirs. This may work with many assets and material possessions, but land is different. Dividing up land may:

- Result in an unequal allocation.

- Reduce the ability to manage forest land.

- Result in land fragmentation.

- Damage or destroy critical natural resources.

Other options allow the property to remain largely intact providing shared benefits of more extensive acreage to the next generation. The options can be fairly simple (e.g., a family trust), or complex (e.g., a family limited partnership [FLP], s-corporation, or limited liability company [LLC]). All these options require the services of an experienced legal professional, preferably with experience in estates with landholdings.

- Permanent Land Protection—Permanent land protection measures often are a routine component of estate planning, particularly if there are financial needs and strong emotional and family ties to the land. Permanent measures can offer ways to meet both financial and emotional goals. Options include:

- Giving or selling land to an entity that will carry on long-term stewardship.

- Retaining the land, but giving or selling a conservation easement.

- Combining these approaches.

Alone or combined, these options can provide opportunities for reducing value to minimize state or federal estate taxes and provide income tax benefits to the current generation of landowners, enabling management to continue and restricting development on key segments of the property.

- Conservation Easements—A conservation easement is a flexible, effective tool to permanently protect land from subdivision, development, and mineral extraction. Easements are designed to reflect and maintain a property’s conservation values and to incorporate landowner and easement-holder objectives. The landowner retains ownership, the land remains on the tax rolls, and the easement restrictions pass with the land to future owners. A conservation easement may allow a landowner to:

- Continue good stewardship of the land. Most New Hampshire easements encourage good forest and farm management, and allow harvesting wood and agricultural products. An easement may require a forest management plan and harvest supervision by a forester.

- Ensure the land remains undeveloped in perpetuity, or allows limited development while restricting subdivision, structures, and commercial and industrial uses on most of the property.

- Provide income or estate tax benefits. Development rights given up through an easement can be valued by a qualified appraiser. If the easement meets IRS requirements, the easement value may be considered a charitable donation for income tax purposes. A conservation easement generally lowers the value of the land and may reduce the value of an estate, thereby reducing potential federal estate taxes.

- Receive direct financial benefits by selling a conservation easement, though this option is available in limited cases.

RECOMMENDED PRACTICES

- Get help. Seek an adviser with experience in estate planning, real estate, and land conservation. Landowners can find help by contacting one of the approximately 40 private, nonprofit land trusts operating in New Hampshire. The Land Trust Alliance is a national organization that provides training, guidance, accreditation and coordination for land trusts and lists them at www.lta.org. UNH Cooperative Extension offices in each county have staff who can provide further advice and guidance.

- Plan ahead. It's never too early to begin the estate planning or land conservation process. It is the best way to realize your long-term goal for good forest stewardship.

CROSS REFERENCES

1.1 First Steps in Forest Management; 1.2 Setting Objectives; 1.3 Forest Management Planning.

ADDITIONAL INFORMATION

Frame, G. 2006. A Forester's Guide to Conservation Easements. Society for the Protection of New Hampshire Forests, Concord, N.H. 36 p.

Lind, B. 2005. Conserving Your Land: Options for New Hampshire Landowners. Center for Land Conservation Assistance, Concord, N.H.

Levite, R. Conservation Restrictions and Estate Planning. UMass Extension. http://www.umass.edu/nrec/pdf_files/conservation_restrictions_land_protection.pdf Accessed January 28, 2010.

Levite, R. Estate Planning for Private Landowners. UMass Extension and the Green Valley Institute. http://www.rifco.org/Estate_Planning_for_Private_Landowners.pdf Accessed January 28, 2010.

Penn State College of Agricultural Sciences, Agricultural Research and Cooperative Extension. Forest Stewardship Series—Estate Planning. 2008. The Pennsylvania State University. UH-105. 6 p.

USDA Forest Service. Preserving the Family Woods. USDA For. Serv. NA—State and Private Forestry. http://na.fs.fed.us/pubs/stewardship/preserving_family_woods_lr.pdf Accessed January 28, 2010.

Siegel, W., H. Haney, and J. Greene. Estate Planning for Forest Landowners: What Will Become of Your Timberland? USDA For. Serv. Gen. Tech. Rep. SRS-112. http://www.srs.fs.usda.gov/pubs/gtr/gtr_so097.pdf Accessed January 28, 2010.