Navigating QuickBooks Desktop Discontinuations

If you’ve logged into QuickBooks Desktop lately, you might have gotten a pop-up alert like the one below. Though many of us are trained to immediately close pop-ups without reading them, this is one that you want to pay attention to!

For New Hampshire farmers, this alert can be alarming; May is not a great time for a farmer to have an upcoming (and unsolicited) change to their record keeping system! This blog will help you understand what’s happening, if you need to pay attention and how to navigate this transition smoothly if need be.

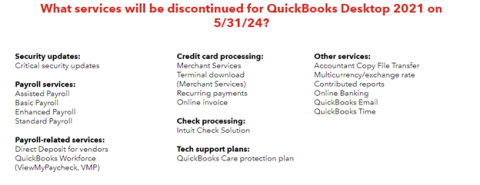

Lately, QuickBooks has been on a three-year cycle for sunsetting certain versions of their Desktop software. In other words, three years after a new version of Desktop is launched, QuickBooks stops supporting that version. In line with this pattern, in March of 2024, Intuit (the owner of QuickBooks) announced the discontinuation of support and services for 2021 QuickBooks Desktop software. This means that after May 31, 2024, users with 2021 Desktop won’t receive critical security updates or have access to: live technical support, QuickBooks Desktop Payroll, QuickBooks Desktop Payments, online bank feeds and other services through QuickBooks Desktop 2021 software.

If you’re using any of the 2021 versions of QuickBooks Desktop for your farm financial recordkeeping, this change will affect your ability to use the functions listed above. To find out which version you have, simply look at the title of the application when you open it on your computer. In the photo below, the version or “edition” is 2021.

When you open Desktop, you’ll still be able to manually enter transactions, produce some reports, and access previous years’ data. The graphic below shows what services will be discontinued for QuickBooks Desktop 2021. Though many of the services listed are important and useful automations, the biggest disruption may come from no longer having access to Online Banking, what many call “Bank Feeds".

Bank Feeds is a big draw for many QuickBooks users because it can save many hours of data entry by automatically bringing in bank transactions into the QuickBooks file. It also can cut down on minor errors because transaction details like payment amount and date aren’t manually entered for each transaction.

Some businesses who’ve faced this “sunsetting” of Desktop versions in the past have continued to import bank transaction data by downloading bank transactions (.qfx files) and converting the file to a (.qbo file), a version that QuickBooks can read. There are several third-party converters you can pay for to do this conversion online but be mindful of sending sensitive financial data to a third party without reading (and fully understanding!) their security, privacy and data protection policies. Alternatively, for those with some tech skills, there are many online discussion forums with posts outlining how some have converted file types on their own.

Even if there are viable workarounds to the discontinuation of some features, without the necessary updates, your software could become vulnerable to security threats, and you won’t be able to call support to ask for help.

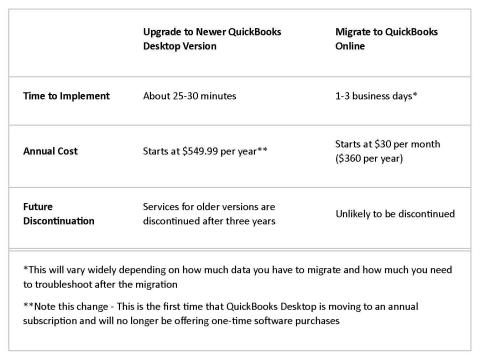

If you want to continue using Desktop with all the features and support after May 31, 2024, you have two options.

Watch this video as an overview of the migration process. If you decide to migrate to QuickBooks Online, here are the steps you need to follow:

- Prepare Your QuickBooks Desktop Data for Export: Clean up your data including: Customer and Vendor lists, Accounts Receivable, Accounts Payable and Product lists before you migrate, ensure your company file isn’t too big to export, create a local backup of the file and print a copy of your Sales Tax Liability report, if applicable.

- Move Your QuickBooks Desktop File to QuickBooks Online: Sign in as an admin, go to Company, then select Export Your Company File to QuickBooks Online, select Get started, sign in as an admin to your QuickBooks Online company, select Choose online company, and choose the company you want to replace with your company file.

Remember, don’t rush the process, create a company backup before you do anything and double-check everything to avoid mistakes. If you’re nervous about doing it yourself or if you run into any issues, QuickBooks experts can help move your data at no cost.

Once you’ve migrated your data over to Online, run a Profit and Loss report and a Balance Sheet report in both Online and Desktop and compare the two. Here's how to run the reports and compare everything to ensure they match.

A few tips to keep in mind throughout this process:

- Know that it’ll take some time to get used to the new interface. In Online, the setup is different, the layout is different and some of the names of features and items are also different! This article will help you be prepared for some of that and this video might help orient you to the new space.

- Get familiar with the QuickBooks Support pages; they have a ton of helpful videos and a Q&A page where your question may already have been answered.

- If you struggle to get used to the new look and feel of QuickBooks Online, try the Desktop App which has a navigation map that is similar to what you’re familiar with in QuickBooks Desktop.

If you do choose to move to Online, you’ll also be faced with the choice of what level subscription to get. Here’s a comparison of the Online subscription levels to help you choose the right one for your farm. Additional information about choosing the right subscription level can be found here.

Though QuickBooks is often thought of as the go-to solution for recording keeping software, their transition to a subscription only model is leaving many farmers and agricultural service providers looking for other options. Here are a few alternative apps to consider if moving away from QuickBooks is something you’re considering: Ambrook, FarmBooks, FarmRaise, Wave, Quicken and Xero.

Don’t forget the trusty spreadsheets available in Google Sheets or Microsoft Excel. Many small farms can do much of what they need without the need for accounting-specific software. At UNH Extension, our Agricultural Business Management team can work with you to customize farm financial recordkeeping templates to fit your farm’s needs.

Hopefully this blog helps you navigate this upcoming change smoothly. If you want to talk one-on-one about farm financial recordkeeping or have any questions on the migration process, please email Jesse Wright.

Extension Services & Tools That Help NH Farmers Grow

Newsletters: Choose from our many newsletters for production agriculture

Receive Pest Text Alerts - Text UNHIPM to (866) 645-7010